What Is IRR In Real Estate?

In the realm of real estate investing, understanding financial metrics is crucial to making informed decisions. One such metric that often takes center stage is the Internal Rate of Return, commonly abbreviated as IRR. In this comprehensive guide, we’ll delve deep into what IRR means in the context of real estate, why it’s essential for investors, and how to calculate it effectively.

IRR: Unveiling the Core Concept

The Basics of IRR

Before diving into the complexities of IRR, let’s establish its fundamental concept. The Internal Rate of Return is a financial metric used to evaluate the potential profitability of an investment over time. In the world of real estate, it helps investors gauge the attractiveness of a particular property or project.

Significance in Real Estate

Investors and real estate professionals use IRR to assess the potential returns of an investment property. It takes into account not only the property’s purchase price but also the cash flows it generates over time, considering factors like rental income, expenses, and the eventual sale price.

Calculating IRR: A Step-by-Step Guide

The Formula Unveiled

To calculate IRR for a real estate investment, a detailed financial model is required. The IRR formula considers all cash flows associated with the property, including both income and expenses, over the expected holding period. It then computes the rate at which these cash flows equate to the initial investment.

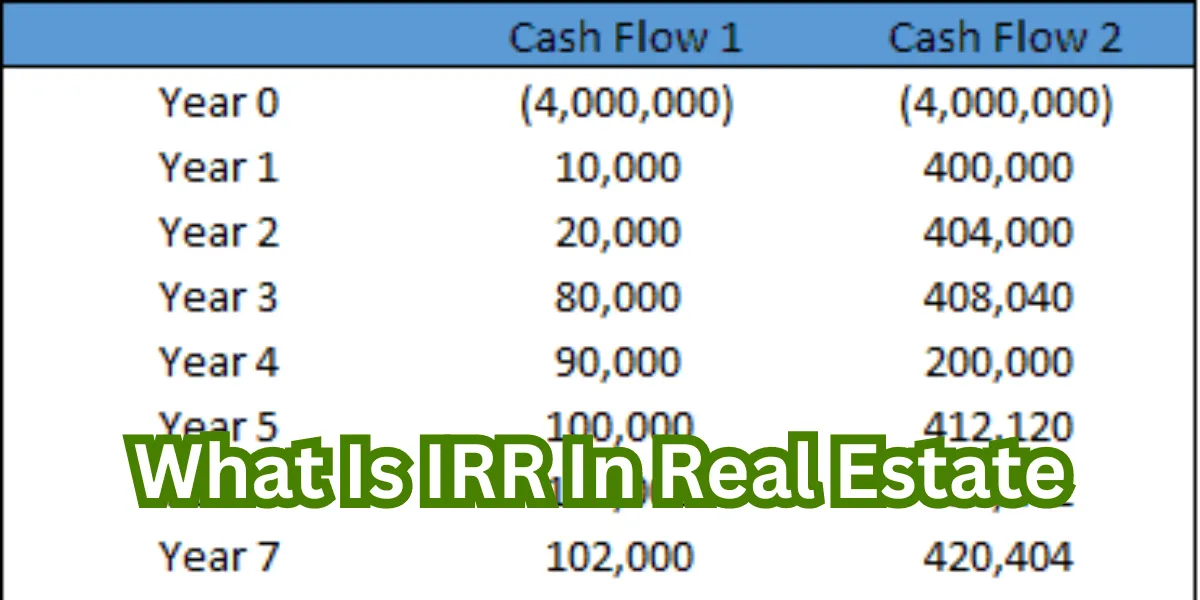

Practical Example

Let’s illustrate this with an example. Suppose you plan to invest in a rental property. You’ll need to consider the initial purchase price, monthly rental income, property management fees, maintenance costs, and the anticipated selling price when you decide to sell the property.

Interpreting IRR Results

Interpreting the IRR Percentage

Once you’ve calculated the IRR for a real estate investment, you’ll be presented with a percentage figure. This percentage represents the annualized return on your investment. A higher IRR typically indicates a more attractive investment opportunity.

Comparing IRRs

Investors often compare the IRR of different properties to determine which one offers the best return potential. It’s crucial to remember that IRR is just one piece of the puzzle, and other factors, such as risk, financing options, and market conditions, should also be considered.

The Caveats and Considerations

Limitations of IRR

While IRR is a valuable tool, it does have its limitations. It assumes reinvestment at the same rate, which may not always reflect real-world scenarios. Additionally, IRR can be sensitive to changes in cash flow timing, making it essential to thoroughly understand the model’s inputs.

Other Metrics to Complement IRR

To make well-informed investment decisions, savvy real estate investors often use a combination of financial metrics, including Net Present Value (NPV) and Cash-on-Cash Return, alongside IRR.

In conclusion, the Internal Rate of Return (IRR) is a vital concept in the world of real estate investment. It serves as a powerful tool for evaluating the potential profitability of investment properties. By understanding IRR and how to calculate it effectively, investors can make informed decisions that align with their financial goals and risk tolerance.

Al Sahaa Real Estate:

Al Saha Real Estate is a prominent player in the real estate market, known for its commitment to excellence and customer satisfaction. With a portfolio spanning residential, commercial, and industrial properties, al sahaa real estate has earned a reputation for delivering quality and value. Founded with a vision to transform the real estate landscape, Al Saha has consistently delivered on its promise to provide premium properties that cater to diverse needs and preferences. Whether you’re looking for a dream home or an investment opportunity, Al Saha Real Estate offers a range of options tailored to meet your requirements.